Global

Coverage

Customer

Data Protection

Wide Range of

Data Sources

GDPR

Compliant

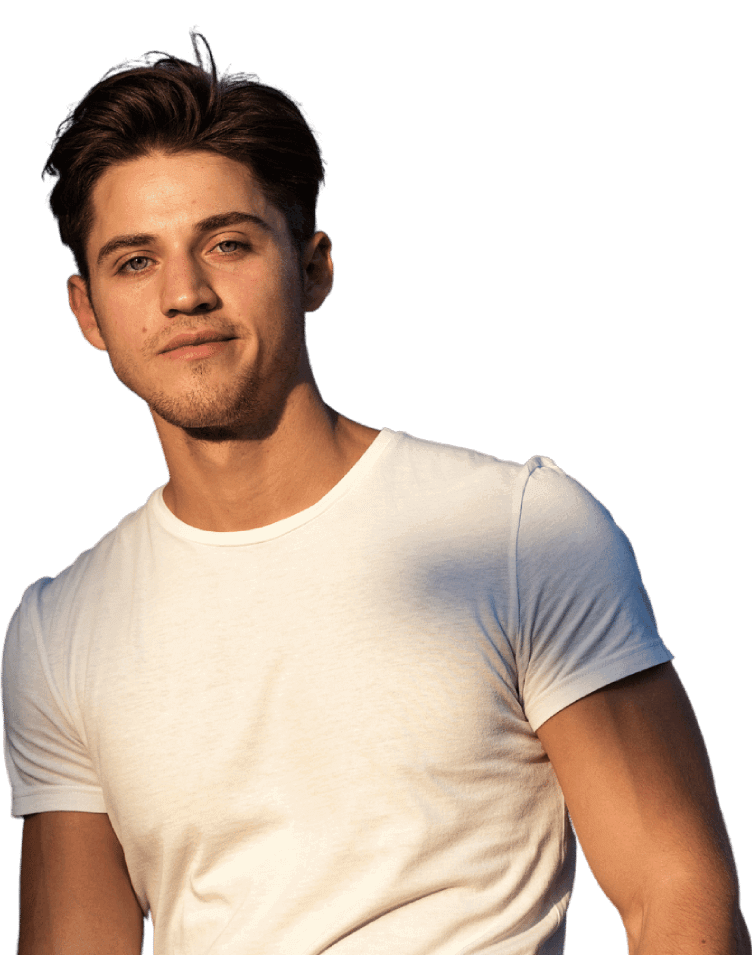

KYC Solutions for Regulatory Compliance

Built with robust security measures, our KYC solutions provide a secure and reliable environment for verifying customer identities. With our streamlined processes, we guarantee swift and precise automated verification, enabling businesses to easily onboard customers. Trusted by a vast clientele, our AI technology has earned a reputation for its reliability and performance. Partner with us, a leading KYC solutions provider, to enhance compliance efforts and foster trust in your business relationships.

Our Comprehensive Suite Of Solutions

Identity Verification

Our KYC software streamlines the verification process through seamless integration and intuitive user experience, ensuring a hassle-free and secure onboarding experience for your customers.

Know Your Customer (KYC)

To maintain compliance with KYC/AML regulations, it is crucial to avoid penalties, simplify the identity verification process, and accelerate remote customer onboarding.

Anti-money Laundering (AML)

To safeguard against illicit financial activities and money laundering risks, businesses and financial institutions can rely on cutting-edge AML solutions.

ID Verification

By incorporating these cutting-edge identity verification tools, businesses can ensure precise and reliable authentication processes.

Age Verification

Ensuring compliance with regulatory requirements and providing a user-friendly experience that complies with age restrictions are key objectives of KYC solutions.

Know Your Business (KYB)

Know Your Business (KYB) solutions offer a robust and all-encompassing business identity verification service, empowering enterprises in Norway to validate critical corporate information with the highest level of authenticity and accuracy.